San Francisco Federal Credit Union

Why Join?

- Competitive rates when you borrow.

- Higher dividends when you want to save.

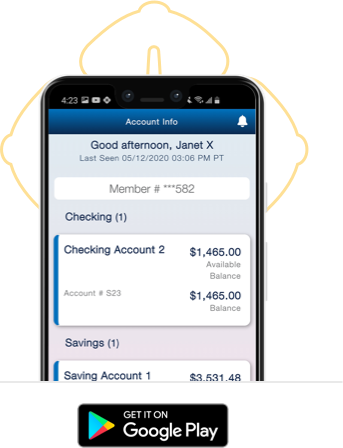

- Online and mobile banking 24/7.

- Free access to 30,000+ CO-OP Network ATMs.

Your Financial Partner for Life

Let us help you plan your life journey.